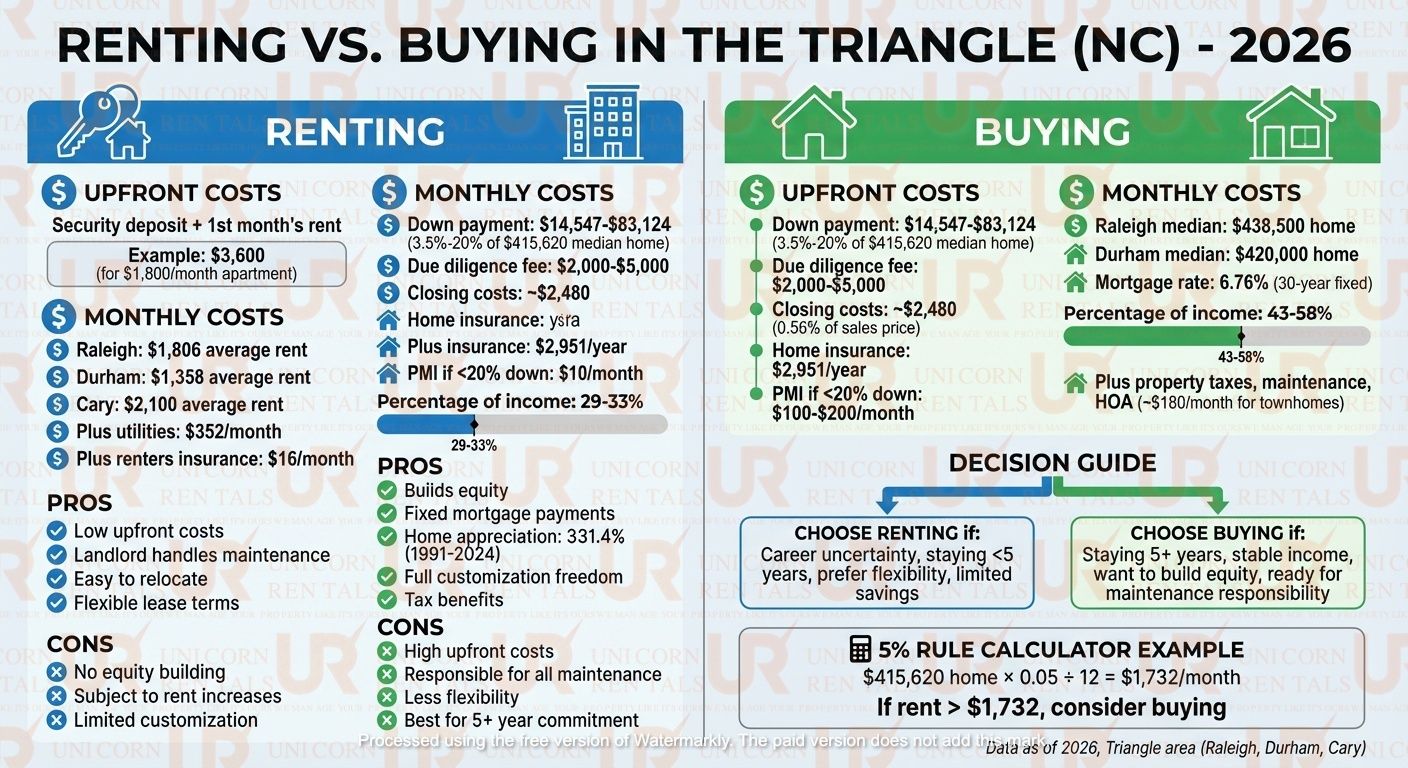

Should you rent or buy in the Triangle in 2026? It depends on your income, long-term plans, and lifestyle priorities. Renting takes up a smaller portion of household income – 33% in Wake County and 29% in Durham County – compared to buying, which demands 58.3% and 43.4%, respectively. Renting offers flexibility and lower upfront costs, while buying builds equity and wealth over time.

Key Points:

- Renting Pros: Lower upfront costs, easier to relocate, landlord handles maintenance.

- Buying Pros: Builds equity, stable payments, freedom to customize your home.

- Costs: Renting averages $1,806/month in Raleigh, while a $415,620 home requires a $14,547–$83,124 down payment plus closing costs.

Quick Comparison:

| Factor | Renting in the Triangle | Buying in the Triangle |

|---|---|---|

| Upfront Costs | Low (1st month’s rent + deposit) | High (down payment + fees) |

| Monthly Costs | 29–33% of income | 43–58% of income |

| Maintenance | Landlord handles it | Homeowner’s responsibility |

| Flexibility | Easy to relocate | Best for staying 5+ years |

| Equity | None | Builds wealth over time |

If you’re staying in the area for 5+ years and have a stable income, buying may be the better financial move. Otherwise, renting provides financial relief and mobility.

Renting vs Buying in Triangle NC: Cost Comparison 2026

1. Renting in the Triangle

Upfront Costs

When it comes to renting, the initial cash outlay is much smaller compared to buying a home. Typically, you’ll need to cover a security deposit – usually the equivalent of one month’s rent – and the first month’s rent. For instance, renting a $1,800 apartment in Raleigh would require around $3,600 upfront. On the other hand, purchasing a $400,000 home with a 5% down payment means you’ll need about $20,000, plus additional closing costs. While renting is easier on your wallet at the start, it’s important to plan for ongoing monthly expenses.

Monthly Costs

Monthly rental costs can vary significantly depending on where you live in the Triangle. As of January 2026, the average rent in Raleigh is $1,806, while Durham comes in lower at $1,358. Suburban areas tend to be pricier – Cary averages $2,100, Garner sits at $1,975, and Morrisville is $1,945. On top of rent, you should budget for utilities, which average $352 per month, and renters insurance, which typically costs about $16 monthly.

Long-Term Financial Outlook

Although renting saves you money upfront, it doesn’t contribute to building equity. Each rent payment goes to your landlord rather than toward your own financial assets. That said, renting does provide predictable costs, as your lease locks in expenses for its duration. However, rising dwelling insurance costs in 2026 have led to higher rent renewals, leaving some tenants with unexpected increases.

"Average rental prices still require a ‘significantly smaller portion of wages’ than all the expenses associated with homeownership." – Jason Parker, Real Estate Reporter, WRAL TechWire

Lifestyle Factors

Renting is a great option for those new to the Triangle or unsure about their long-term plans. It offers flexibility, allowing you to relocate without the financial penalties of selling a home – a process that can take years to break even. Another perk? Your landlord handles major repairs and maintenance, sparing you from unexpected expenses. Renting also gives you the chance to "test-drive" neighborhoods like Downtown Cary, North Hills, or areas near Research Triangle Park before committing to a mortgage. Plus, leasing typically has less stringent credit requirements than securing a mortgage, making it more accessible for first-time residents still working on their financial stability.

2. Buying in the Triangle

Upfront Costs

Buying a home in the Triangle comes with a hefty initial investment compared to renting. First, there’s the down payment, which typically ranges from 3.5% to 20% of the home’s purchase price. For a median-priced home at $415,620, that’s anywhere between $14,547 and $83,124. On top of that, North Carolina requires a non-refundable due diligence fee – usually 3%–5% of your offer or at least $2,000–$5,000. This fee secures the property during inspections, but if you decide to back out, you lose this money entirely.

Closing costs in North Carolina are lower than the national average, averaging 0.56% of the sales price – around $2,480 for a typical home. Other upfront expenses include a home inspection ($300–$500), appraisal ($300–$400), title insurance (about $2.60 per $1,000 of the loan), loan origination fees (0.5%–1% of your loan), and the first year of homeowner’s insurance, which averages $2,951 annually. However, rates in the Triangle are generally lower than in coastal areas. If your down payment is less than 20%, plan to add $100 to $200 per month for Private Mortgage Insurance (PMI).

Monthly Costs

Your monthly costs as a homeowner can vary significantly depending on your home price and financing terms. For example, with Raleigh’s median home price at $438,500 and Durham’s at $420,000, mortgage payments will likely make up the bulk of your monthly expenses. At the May 2025 average rate of 6.76% for a 30-year fixed mortgage, these payments can be substantial, even before adding taxes, insurance, and maintenance.

One advantage of owning is that your mortgage payment remains fixed for the life of your loan, offering long-term cost stability. However, all maintenance and repair expenses fall squarely on your shoulders. Whether it’s replacing an HVAC system, fixing a leaky roof, or addressing a plumbing issue, those costs can add up quickly. If you purchase a townhome, you’ll also need to budget for HOA fees, which average around $180 per month and typically cover exterior maintenance.

Long-Term Financial Outlook

While the upfront and monthly costs of buying might seem daunting, the long-term financial benefits can make it worthwhile. Over time, you build equity, which can offset the initial expenses. Between 1991 and late 2024, North Carolina housing prices surged by 331.4%, and many Raleigh homeowners now find themselves "equity rich", meaning their home’s value is more than double their remaining mortgage balance. Even recently, homes purchased at the median price in January 2023 saw a 6% increase in value within just one year.

Experts often recommend following the five-year rule – staying in your home for at least three to five years to build enough equity to cover transaction and closing costs. The Triangle’s housing market benefits from a persistent shortage of homes and strong demand driven by the tech and healthcare industries. This demand creates a price "floor", helping properties retain their value even during market slowdowns. However, rising tariffs on construction materials, including 145% tariffs on lumber and steel, could drive up the cost of new builds.

Lifestyle Factors

Owning a home in the Triangle requires a certain level of stability and commitment. Most lenders prefer borrowers who have held the same job position for at least two years. Additionally, North Carolina operates under a "buyer beware" system, making thorough home inspections an absolute must.

The market is currently shifting, with inventory up 52% year-over-year as of March 2025. Homes now spend an average of 45 days on the market, compared to just 23 days the year before, giving buyers more time and negotiating power. Ownership offers the freedom to personalize your space – whether that’s renovating, painting, or landscaping – but it also means taking on all responsibilities, from lawn care to emergency repairs.

Living in the Triangle comes with its own challenges. Summers can hit 110°F with high humidity, and spring brings intense pollen seasons, making HVAC upkeep and air filtration essential. Unlike renting, where landlords handle maintenance, homeownership places all these responsibilities – and their costs – squarely on you.

sbb-itb-aa27f6d

Pros and Cons

Deciding whether to rent or buy in the Triangle means balancing financial considerations with your lifestyle needs. Each option comes with its own set of perks and challenges, impacting both your budget and how you live day-to-day.

From a financial standpoint, local data shows that renting generally takes up a smaller portion of household income compared to buying. Meanwhile, homeowners in the Triangle have seen property values rise by an impressive 331.4% between 1991 and the third quarter of 2024. Experts agree that owning a home in this area often proves to be a worthwhile investment.

Lifestyle factors matter, too. Renting offers flexibility – perfect if your job situation changes or you’re still exploring which neighborhood feels like home. Plus, your landlord handles repairs and maintenance, taking that responsibility off your plate. On the flip side, buying a home ties you to one location and makes you responsible for upkeep. However, it also gives you stability, with fixed mortgage payments protecting you from rising rents. Owning a home also means you can renovate and make the space truly your own.

Here’s a quick comparison of the key differences:

| Factor | Renting in the Triangle | Buying in the Triangle |

|---|---|---|

| Upfront Cost | Low (security deposit + 1st month’s rent) | High (down payment, closing costs, due diligence) |

| Monthly Payment | Typically lower (29-33% of income) | Higher (43-58% of income) |

| Maintenance | Handled by landlord | Your responsibility |

| Equity | None (you’re paying someone else’s mortgage) | Builds wealth through equity and appreciation |

| Flexibility | High (easy to move after lease ends) | Low (better for staying 5+ years) |

| Cost Stability | Subject to rent increases | Fixed mortgage payments provide predictability |

| Tax Benefits | None | Possible mortgage interest deductions |

| Customization | Limited by lease terms | Full freedom to renovate and personalize |

Ultimately, your decision should align with your long-term goals. A general rule of thumb is the five-year guideline: if you plan to stay in the Triangle for at least five years, buying often makes more financial sense. It gives you time to build equity and offset the upfront costs. But if your future feels uncertain – whether due to career changes or personal circumstances – renting offers the flexibility to adapt without the financial risk of selling a home too soon.

Conclusion

Deciding whether to rent or buy in the Triangle comes down to evaluating your financial situation and what fits your lifestyle. If you’re planning to stick around for at least five years, buying often makes better financial sense. You’ll start building equity, take advantage of the area’s solid home appreciation – Cary homes alone appreciated nearly 4.7% in early 2025 – and enjoy the stability of predictable monthly payments. On the other hand, if your career plans are uncertain or you value the freedom to try out different neighborhoods, renting provides flexibility without the responsibility of home maintenance.

"If you’re planning to stay in the area for 5+ years, have a stable income, and want to build long-term financial security, buying a home in Cary or Raleigh could be one of the smartest investments you make." – Caleb Edwards, Local Real Estate Expert, Edwards Real Estate Group

A helpful tool to guide your decision is the 5% Rule: take the home’s purchase price, multiply it by 0.05, and divide by 12. If your monthly rent is higher than the result, buying might make more financial sense. For example, with a $415,620 home (the Triangle’s median price), the calculation comes to about $1,732 per month. If your rent for a comparable property exceeds this number, it’s worth seriously considering buying. This simple formula highlights the financial trade-offs involved.

While renting can mean lower upfront costs, buying offers the opportunity to build wealth over time through equity and appreciation. The right choice depends on your long-term plans, financial readiness, and whether you prioritize stability or flexibility. With the Triangle’s robust housing market supporting both options, the best path is the one that aligns with your personal goals and circumstances.

FAQs

What are the main financial advantages of buying a home in the Triangle area?

Buying a home in the Triangle comes with some solid financial advantages. For starters, opting for a fixed-rate mortgage means you won’t have to worry about climbing rent prices or inflation affecting your monthly payments. Your costs stay predictable, giving you peace of mind. Plus, as you chip away at your mortgage, you’re building equity – a valuable asset that grows as property values potentially rise, adding to your long-term financial security.

Another perk? Tax breaks. Homeownership often lets you deduct mortgage interest and property taxes, which can help lower what you owe at tax time. These benefits make purchasing a home an appealing option for first-time buyers in the Triangle area.

Why is renting in the Triangle more flexible than buying a home?

Renting in the Triangle offers more freedom compared to buying, especially for those navigating their first rental experience. With shorter lease terms and fewer upfront expenses – usually just a security deposit and the first month’s rent – renting makes it easier to move when life takes an unexpected turn. Whether it’s starting a new job, wrapping up school, or other personal changes, relocating as a renter is far simpler than dealing with the lengthy process of selling a home or breaking a mortgage.

Another big perk? Renters can skip the headaches of maintenance and major repairs, as those tasks are typically handled by the landlord. This makes renting an ideal low-hassle choice for anyone seeking a “move-in-ready” lifestyle. Whether you’re exploring different neighborhoods or adjusting to the Triangle’s rapid growth, renting keeps your living arrangements flexible and stress-free.

What should I think about when choosing between renting and buying a home in the Triangle?

Deciding whether to rent or buy in the Triangle largely depends on your financial situation and lifestyle preferences. Renting typically comes with lower upfront costs, such as a security deposit and the first month’s rent. In contrast, buying a home requires a more substantial financial commitment, including a down payment (usually 5–20% of the home’s price), closing costs, and other associated expenses. Monthly costs also vary: renters pay rent, which can increase over time, but they avoid responsibilities like property taxes and maintenance. Homeowners, however, face mortgage payments along with taxes, insurance, and repair costs, which can add up quickly.

Your lifestyle goals are another key factor. Renting provides flexibility, making it a great option if you’re uncertain about your long-term plans, want to try out different neighborhoods, or need the ability to move easily. On the other hand, buying a home allows you to build equity, personalize your space, and enjoy stability – especially if you’re planning to stay in one place for at least five years. To make the best choice, think about your budget, debt, how long you plan to stay in the area, and the type of lifestyle that works best for you.

Related Blog Posts

- How Much Should You Charge for Rent in Raleigh, Durham & Chapel Hill in 2026 (By Bedroom & Neighborhood)

- 5 Fastest-Growing Triangle Neighborhoods for Airbnb

- best neighborhoods in Wake Forest, Morrisville and Garner for short-term rentals

- Extended Stay / Mid-Term Rentals vs Short-Term (Airbnb) vs Long-Term Rentals: Profitability in the Raleigh–Durham Triangle, NC