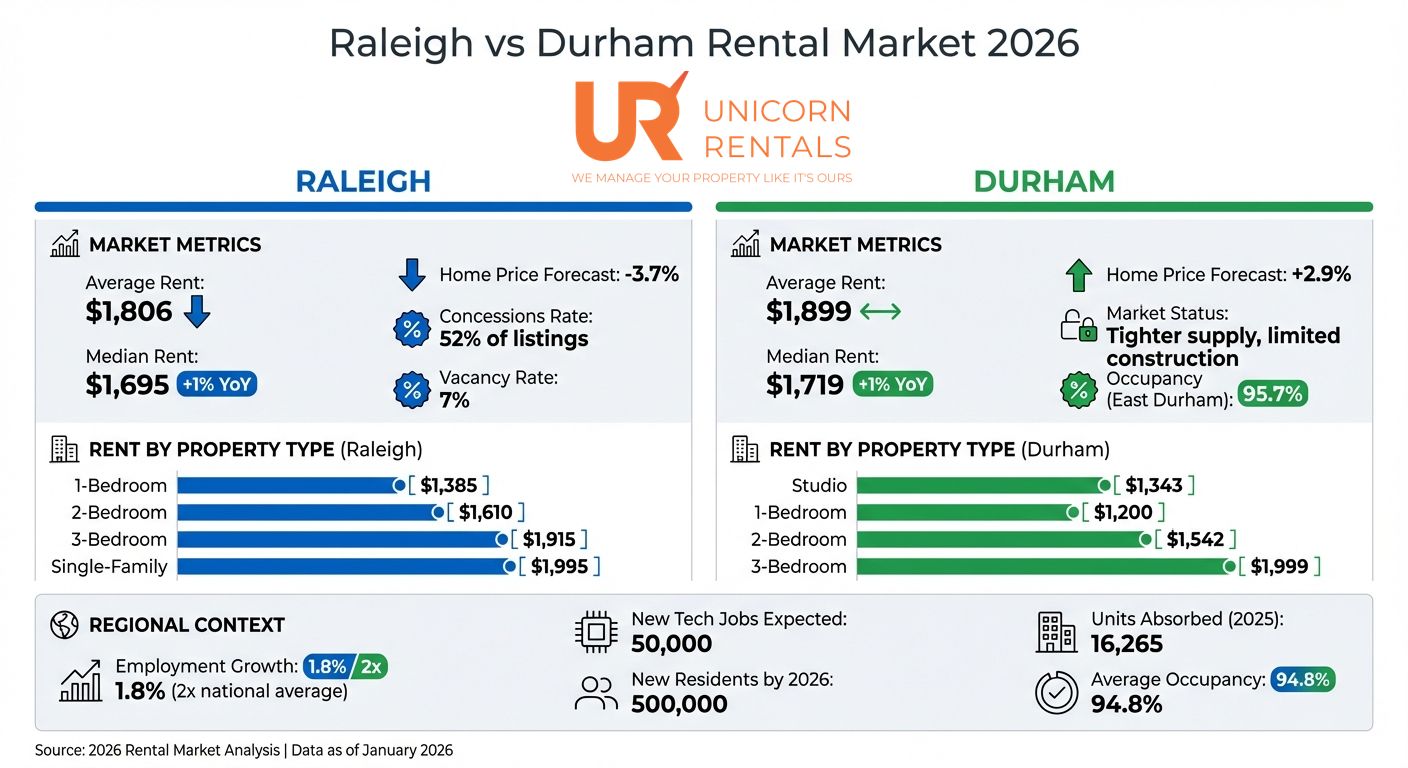

The Raleigh-Durham rental market in 2026 is shaped by diverging trends in both cities. Raleigh is seeing a cooling market with higher inventory and slower rent growth, while Durham faces tighter supply, driving stronger demand and steadier rents. Key takeaways include:

- Raleigh’s Average Rent: $1,806 (slight decline), with concessions on 52% of listings.

- Durham’s Average Rent: $1,899 (steady), benefiting from limited new construction.

- Job Growth: The region is adding 50,000 tech jobs and expects 500,000 new residents by 2026.

- Construction Trends: New housing starts have slowed, tightening supply and stabilizing vacancy rates (94% occupancy overall).

- Investment Opportunities: Durham and Chapel Hill show stronger growth potential, while Raleigh’s market favors tenant concessions and competitive pricing.

For landlords, 2026 offers opportunities to adjust strategies based on these trends, focusing on pricing, location, and property type to maximize returns.

2025 Rental Market Recap: What Happened Last Year

2025 Market Performance Numbers

The Triangle’s rental market in 2025 marked a turning point after a challenging 2024. Following a 3.3% drop in rents the previous year, the market began to stabilize by mid-2025, with rents showing a modest decline of just –0.4%.

In the first quarter of 2025, Raleigh’s median rents were $1,385 for 1-bedroom units, $1,610 for 2-bedroom units, and $1,915 for 3-bedroom units. By September, asking rents for 0-2 bedroom units had fallen 5.1% compared to the same period in 2024. Meanwhile, Durham’s average rent remained almost unchanged at $1,899, just $1 less than the year before.

"Asking rents inched lower on a year-over-year basis, as operators prioritize occupancy over rental increases."

– Peter O’Neil, National Director of Research, Northmarq

Vacancy rates edged up to 8.0% by mid-2025, a 0.5% increase from 2024. Despite this, average occupancy across the Triangle improved to 94.8% in the second quarter, a 180-basis-point rise. This occurred even as the market absorbed a wave of new supply – about 12,000 multifamily units were delivered in 2025, slightly fewer than the 13,000–14,487 units completed in 2024.

Landlords adapted to the shifting market by offering more incentives like free rent, gift cards, and waived fees to attract tenants. On average, multifamily units spent 28 days on the market as renters took their time weighing the many options available.

These trends helped stabilize the market, paving the way for strong renter demand and continued population growth.

Population Growth and Renter Demand in 2025

With the rental market finding its footing, the Triangle saw a surge in renter activity and population growth. The region ranked 6th nationally for apartment absorption, with 16,265 units leased in the year ending Q2 2025. During the first half of the year alone, net move-ins surpassed 5,100 units, keeping pace with 2024’s record-setting numbers.

Raleigh’s metro population climbed to 1,661,000 in 2025, reflecting a 1.96% increase from the previous year. Household formation also grew significantly in 2024, rising by 3.4% – the second-highest rate among major U.S. metro areas – which sustained strong demand for rental housing. Employment growth in the region was equally impressive, clocking in at 1.8% through July 2025, more than double the national average. Key sectors like Education and Health Services added 6,600 new jobs, while Professional and Business Services made up 19.1% of the employment share.

Central Raleigh led the way in renter demand, absorbing 3,169 units and achieving 95.0% occupancy. Southeast Raleigh followed with 2,369 units absorbed. East Durham stood out with the highest occupancy rate at 95.7%, even after absorbing 1,491 units. Many renters opted to renew their leases, with the average term stretching to 12.2 months, rather than relocating.

Raleigh Real Estate Market ! Why Everyone’s Moving?

Major Rental Market Trends in 2026

Following a period of market turbulence, the Triangle’s rental market is entering a phase of adjustment in 2026. The construction boom of 2024 and 2025, which brought nearly 14,500 new units in 2024 alone, has tapered off significantly. By September 2025, new construction had dropped to 8,593 units, tightening the supply of available rentals. This slowdown, coupled with strong renter demand, is setting the stage for rents to climb again after years of stagnation.

Interestingly, Raleigh and Durham are charting different paths. Raleigh’s growing inventory is creating more opportunities for renters, while Durham remains constrained by limited new construction. This means landlords in these two cities will need tailored strategies to navigate these diverging trends, which are likely to result in varied rent growth depending on the type of property.

Expected Rent Growth by Property Type

With fewer new apartments entering the market, rents are expected to rise in 2026. After a period of flat or declining rents, the balance between supply and demand is shifting in favor of landlords.

Single-family rentals are expected to see the strongest rent growth. Limited availability of detached homes, combined with mortgage rates averaging 6.3%, is keeping many would-be buyers in the rental market longer – especially families looking for more living space.

Industrial and warehouse properties are also projected to experience significant rent increases, with rates climbing 4%–5% in 2026. This growth is fueled by expansions in industries like biotech and logistics. Meanwhile, smaller units such as studios and one-bedroom apartments are anticipated to outperform larger units nationwide, with rent growth rates between 5.3% and 5.9%. This trend is particularly relevant in tech-heavy areas near Research Triangle Park and Apple’s $1 billion campus.

Durham-Chapel Hill saw a striking 14.8% jump in median rents from 2024 to 2025, placing it among the top midsize metros for rent growth. This upward momentum is expected to continue in 2026, as limited new construction keeps supply tight. In contrast, Raleigh’s median rent stabilized at around $1,695 by late 2024, with more gradual increases expected.

"Durham is smaller and traditionally more constrained when it comes to new construction… that pent-up demand will likely benefit Durham and Chapel Hill more than Raleigh."

– Jake Krimmel, Senior Economist, Realtor.com

As rents begin to stabilize, vacancy rates and absorption metrics provide further insight into the evolving supply-demand equation.

Vacancy Rates and Supply-Demand Changes

With fewer new units being delivered, vacancy rates are reflecting a market where demand is catching up to the slower pace of supply growth. This rebalancing is helping to stabilize the market.

Demand for rentals in the Triangle remains exceptionally strong. By mid-2025, the region ranked 6th nationally for apartment absorption, with over 5,100 net move-ins recorded in the first half of the year. Employment growth in the region, which rose by 1.8% through July 2025 – more than double the national average – continues to fuel this demand. High-paying tech jobs from Apple’s $1 billion campus and Meta’s expansion are drawing renters to premium units.

In 2025, landlords offered concessions on 26.7% of units to reduce vacancy time and maintain occupancy – a trend that is expected to ease in 2026 as supply conditions improve. By late 2025, average occupancy across stabilized properties stood at 94.0%. In submarkets like East Durham, occupancy reached 95.7%, even as the area absorbed 1,491 new units.

As the focus shifts from maintaining occupancy to driving rent growth, 2026 marks a pivotal year for landlords in the Triangle. With construction slowing and demand staying strong, landlords are in a position to increase rents without jeopardizing tenant retention.

2026 Rent Forecasts: Raleigh vs. Durham

Raleigh vs Durham Rental Market 2026: Key Metrics Comparison

Raleigh and Durham both recorded a modest 1% year-over-year rent growth as of January 2026. Median apartment rents stand at $1,695 in Raleigh and $1,719 in Durham, but the underlying market conditions suggest these cities are heading in different directions over the next year. Let’s take a closer look at how these trends vary by property type in each city.

Raleigh Rent Projections by Property Type

Raleigh’s higher inventory levels are keeping rent increases relatively modest across most property types. Here’s how the numbers break down as of January 2026:

- One-bedroom apartments: $1,385

- Two-bedroom units: $1,610

- Three-bedroom apartments: $1,915

- Single-family homes: $1,995 (regional average for single-family homes across the metro is $2,580)

Central Raleigh shows stronger demand, with only 16% of properties offering concessions, compared to over 50% in other submarkets. However, with home prices expected to drop by 3.7% in 2026 – the fourth-largest projected decline nationwide – landlords in Raleigh may need to stay competitive with pricing and incentives.

Durham, on the other hand, tells a different story.

Durham Rent Stabilization and Recovery

Durham’s tighter supply pipeline is expected to keep demand strong throughout 2026. Here’s what rental prices look like:

- Studios: $1,343

- One-bedroom units: $1,200

- Two-bedroom units: $1,542

- Three-bedroom apartments: $1,999

In contrast to Raleigh, home prices in the Durham-Chapel Hill area are projected to rise by 2.9% in 2026, highlighting a more favorable environment for property owners.

Southwest Durham currently has the highest concession rate in the Triangle at 32%. Meanwhile, effective rents in Northwest and Downtown Durham average $1,581 per unit, and East Durham maintains a strong 95.7% occupancy rate despite absorbing new inventory.

2025 vs. 2026 Rent Comparison Table

Here’s a side-by-side comparison of key rental metrics for 2025 and 2026, showcasing the differences between Raleigh and Durham:

| Property Type | Raleigh (Jan 2026) | Durham (Jan 2026) | Regional Average |

|---|---|---|---|

| Studio | – | $1,343 | – |

| One-Bedroom | $1,385 | $1,200 | $1,149 |

| Two-Bedroom | $1,610 | $1,542 | $1,100 |

| Three-Bedroom | $1,915 | $1,999 | $2,095 |

| Single-Family Home | $1,995 | – | $2,580 |

| Overall Median | $1,695 (+1%) | $1,719 (+1%) | $2,502 |

While both cities experienced the same 1% annual rent growth in January 2026, the market dynamics driving these numbers differ significantly. Raleigh’s rent growth is restrained by an oversupply of housing, whereas Durham benefits from a tighter supply and affordability challenges. With new construction slowing – down 27% during late 2024 and 2025 as noted earlier – landlords in both cities could regain some pricing power, but Durham appears better positioned for stronger gains.

sbb-itb-aa27f6d

What’s Driving the 2026 Rental Market

Building on the 2025 market trends, the 2026 rental market in Raleigh-Durham is being influenced by three major factors: job growth, mortgage rates, and a significant housing shortage. Understanding these forces can help landlords and investors make better decisions about pricing, property types, and where to focus their efforts.

Job Growth and Economic Expansion Effects

The Research Triangle is solidifying its status as a tech hub in the Southeast. Apple’s $1 billion campus is set to create 3,000 high-paying jobs, while other tech giants like Google, Meta, and Amazon are also expanding in the area. With tech salaries ranging from $80,000 to $150,000, the region is attracting renters who can afford higher-end units.

Employment in Raleigh-Durham grew by 1.8% through mid-2025, which is more than double the national average. By 2026, 50,000 new tech jobs are expected to be added across North Carolina, and the Triangle region is projected to welcome over 500,000 new residents. This population growth has driven record apartment absorption, with 16,265 units leased by mid-2025, outpacing new construction in several areas.

Healthcare is another key driver. A new children’s hospital in Apex will bring 8,000 jobs to the region. Unemployment rates remain low, with Raleigh-Cary at 3.5% and Durham-Chapel Hill at 3.8%, both well below national averages. For landlords, focusing on properties near Research Triangle Park, downtown Durham, or growing areas like Apex could be a smart move, especially as healthcare expansion fuels demand.

While job growth is fueling demand for rentals, mortgage rates are playing a crucial role in shaping homeownership trends.

Interest Rates and Homeownership Patterns

Mortgage rates are expected to average 6.3% in 2026, slightly lower than 2025’s 6.6% but still high enough to keep many would-be buyers in the rental market. The "rate lock-in" effect is significant – 80% of current homeowners have mortgage rates below 6%, making them hesitant to sell.

"Next year will mark the beginning of a long, slow recovery for the housing market." – Chen Zhao and Daryl Fairweather, Redfin Economics Team

This creates a split market. In Raleigh, home sales are projected to decline by 4.4%, with prices falling 3.7% in 2026. In contrast, Durham-Chapel Hill is expected to see home prices rise 2.9%, along with a modest 1% increase in sales. Although the typical monthly mortgage payment is predicted to drop to 29.3% of median income in 2026 – below the 30% affordability threshold for the first time since 2022 – it’s still not enough to prompt a large-scale shift from renting to buying.

High down payments and ongoing affordability challenges are keeping many Gen Zers and young families in the rental market. The national homeownership rate is expected to dip slightly to 64.8% in 2026, down from 65.1% in 2025. For landlords, this means rental demand will remain strong, particularly in areas like Durham, where rising home prices and limited inventory push more people toward renting.

These financial trends are compounded by the region’s housing supply challenges.

Housing Supply and Affordability Issues

Wake County is facing a shortfall of approximately 65,000 housing units, which keeps rental demand high despite ongoing construction efforts. In Durham, limited new construction continues to constrain supply, while Raleigh’s higher inventory levels are helping to moderate rent increases.

"At present, Raleigh is approaching ‘buyers’ market territory’ with inventory building well above pre-pandemic levels and sales remaining slow." – Jake Krimmel, Senior Economist, Realtor.com

The introduction of over 9,000 new apartment units in Raleigh by late 2024 has started to stabilize rents in existing properties, though strong demand is preventing significant price declines. Active listings for townhouses and condos in Raleigh rose by 38.9% year-over-year, compared to a more modest 4.5% growth in single-family home inventory. This divergence is important for landlords deciding which property types to prioritize. In Durham, where the supply pipeline is tighter, any future easing of mortgage rates is likely to unleash pent-up demand, benefiting markets like Durham and Chapel Hill more than Raleigh.

What These Trends Mean for Landlords

As rental markets evolve, landlords need to stay agile to maximize returns and minimize vacancies. The landscape in 2026 calls for competitive pricing, strategic investments, and professional property management to navigate these changes effectively.

Setting Competitive Rent Prices

In January 2026, Raleigh’s average rent dropped to $1,806 (a $53 decrease), while Durham’s average held steady at $1,899. Raleigh’s vacancy rate hit 7%, with 52% of listings offering concessions. To maintain long-term property value, consider offering time-limited move-in specials rather than permanent rent reductions. Localized demand is key – areas like Northwest Raleigh or South Durham, where new construction is sparse, might allow for stronger pricing strategies.

In Durham, a new ordinance bars rent collection for units with "imminently dangerous" conditions. To avoid legal troubles and justify higher rents, make sure your property meets essential standards: secure locks, functional heating, drinkable water, and safe electrical systems.

Where to Focus Your Investments

Investment strategies should align with shifting market fundamentals. In 2026, Durham and Chapel Hill present better opportunities than Raleigh. Raleigh home prices are projected to decline by 3.7%, while Durham-Chapel Hill prices are expected to increase by 2.9%, driven by tighter housing supply. This trend also impacts the rental market, where limited new construction supports lower vacancy rates and steadier rents.

Single-family homes remain a solid investment, with median rents in Raleigh holding at approximately $1,995. If you’re investing in Raleigh, focus on submarkets with less new construction, such as South Durham, East Durham, and Northwest Raleigh. These areas face less competition and offer proximity to major employment hubs. For instance, the new children’s hospital in Apex is set to create 8,000 jobs, while Apple’s $1 billion campus is expected to bring 3,000 high-paying roles .

Using Property Management Services

With rent prices stabilizing and maintenance costs climbing – up 0.88% due to wage inflation – professional property management can be a game-changer. Notably, 70% of property managers predict rent prices will remain flat through 2026.

Unicorn Rentals offers three property management plans tailored to different needs:

- Standard Plan (10% of monthly rent, or 7% for 5+ units): Covers essentials like marketing, tenant screening, rent collection, 24/7 maintenance coordination, and financial reporting.

- Value+ Plan (13% of monthly rent, or 10% for 5+ units): Includes an Owner Protection Package with rent loss guarantees, eviction assistance, malicious damage coverage, and liability protection.

- Premium Plan (15% of monthly rent, or 12% for 5+ units): Offers added benefits like no repair markups, free lease renewals, discounted tenant placement fees, and preventive maintenance inspections.

With lease renewal rates up by 1.6% as tenants prioritize stability and annual market demand reaching 15,812 units absorbed, the Premium Plan can help retain long-term tenants and reduce costly turnovers.

How to Increase Returns in 2026

Using Data to Track Market Changes

Stay on top of real-time rent trends with tools like Zillow and Zumper. These platforms help you compare effective rent (what tenants actually pay) against asking rent, factoring in move-in specials that can skew perceptions. This kind of precise tracking aligns with earlier strategies for understanding renter demand and spotting signs of market saturation.

Since concessions are common, it’s smart to calculate net rent after promotions. This allows you to stay competitive without permanently lowering your base rent. Pay close attention to absorption rates in your local market. For instance, Central Raleigh absorbed 2,245 units annually while maintaining a 93.9% occupancy rate. However, results vary by neighborhood, so tracking your specific area is key. This data-driven approach not only helps you price smarter but also supports proactive strategies for maintaining your property.

Preventive Maintenance and Keeping Tenants Longer

With a wave of new construction hitting the market, older properties face stiff competition from modern units loaded with amenities. Regular maintenance can help your property stay competitive and justify steady rent prices, even as Raleigh home prices are projected to dip by 3.7%.

Focus on features that matter most to renters in the area, such as reliable heating systems, secure locks, and updated fixtures. These practical upgrades resonate with the region’s well-educated tenant base. Given that 56.7% of renters recently renewed their leases, investing in preventive maintenance can reduce costly turnover. Avoiding vacancies, marketing expenses, and tenant placement fees becomes especially important in a market where finding replacements might take longer. By keeping your property in excellent shape, you not only retain tenants but also maintain the rent stability that supports your long-term goals.

Marketing Your Property Effectively

With 32% of rental units offering move-in incentives, it’s crucial to spotlight your property’s strengths to justify full-priced rent. If your property is well-maintained and located near major employers – like Apple’s $1 billion campus or the upcoming Apex children’s hospital expected to create 8,000 jobs – make these advantages front and center in your marketing.

Tailor your efforts to specific demographics tied to local job growth. For example, with 6,600 new positions expected in education and health services by 2025, highlight proximity to hospitals, schools, and transit options to attract professionals. If your property is in areas with little new construction, such as South Durham, East Durham, or Northwest Raleigh, emphasize the reduced competition and the established charm of these neighborhoods – qualities that new developments simply can’t offer.

Conclusion: Getting Ready for Raleigh & Durham’s 2026 Rental Market

Main Takeaways for Landlords

The rental markets in Raleigh and Durham are heading in different directions for 2026. Raleigh is seeing a dip in home prices (down 3.7%) and average rents ($1,806), while Durham is experiencing a boost in home prices (up 2.9%) with rents holding steady at $1,899. This means landlords will need tailored strategies for each city.

Raleigh faces some hurdles – like 52% of listings offering concessions compared to 28% nationally – but demand remains strong. The region absorbed a record-breaking 15,812 units, supported by employment growth of 1.8%, which is more than double the national average. Lease renewal rates have also gone up by 1.6%, as tenants look for stability. Retention is becoming increasingly important, especially as maintenance costs rise by 0.88%, and the average multifamily unit now takes 28 days to lease.

Landlords should focus on attracting high-earning professionals drawn to the area by major projects like Apple’s $1 billion campus, Meta’s data center, and the new children’s hospital in Apex, which together are expected to create 8,000 jobs. These developments highlight the importance of efficient property management.

How Unicorn Rentals Can Help in 2026

Unicorn Rentals offers solutions to help landlords navigate these challenges with ease. Their property management services cover everything from tenant screening and rent collection to 24/7 maintenance coordination and financial reporting. This allows landlords to shift their focus to growing their portfolios while leaving the day-to-day operations in capable hands.

Their tiered pricing plans start at 10% of monthly rent (7% for landlords with five or more units). The Value+ plan includes added protections like loss of rent and malicious damage coverage, while the Premium plan offers perks such as free lease renewals and discounted tenant placement. In a market where over half of rental listings include concessions and leasing conditions can be unpredictable, having a reliable management partner is key.

FAQs

How will tech job growth in Raleigh-Durham impact rental demand in 2026?

The tech industry in Raleigh-Durham is on a fast track, and it’s shaping up to have a big impact on rental demand by 2026. Major players like Apple, IBM, and Red Hat are ramping up their presence in the area, attracting a wave of highly educated, high-earning professionals. As of 2024, nearly 45% of the local population holds a bachelor’s degree, and thousands of skilled workers are relocating to the region every month. This steady influx is keeping the demand for rental housing strong.

The local job market, heavily driven by tech, added about 20,800 jobs last year. Unemployment in the area remains impressively low at 3.2%, well below the national average. Urban neighborhoods like West Raleigh are seeing the most action, with occupancy rates soaring around 95% and record levels of apartment absorption. To stay competitive in this booming market, landlords should target high-income renters and focus on properties that offer prime locations and sought-after amenities.

What steps can landlords in Raleigh take to stay competitive in the 2026 rental market?

To stay ahead in Raleigh’s shifting 2026 rental market, landlords need to prioritize smart pricing, modern amenities, and effective marketing strategies. With average rents hovering around $1,761 and vacancy rates climbing to nearly 7% – the highest seen since 2009 – adjusting to the growing supply and steady demand is critical.

Here’s how landlords can navigate these changes:

- Set rents with precision: Tap into real-time rental data to price units competitively. For properties that are slower to lease, consider offering incentives like a free month of rent or reduced move-in fees.

- Upgrade amenities: Features like energy-efficient appliances, high-speed internet access, and pet-friendly options can make a property more appealing and justify higher rent.

- Cater to tenant preferences: Focus on attracting skilled professionals by marketing properties close to employment hubs like Research Triangle Park or trendy areas such as Central Raleigh and South Durham.

By keeping a close eye on market trends and adapting quickly, landlords can maintain strong occupancy rates and protect their bottom line, even in a more competitive Triangle rental market.

Why is rent growth expected to be stronger in Durham than in Raleigh by 2026?

Durham is projected to experience a 2.9% rise in rent prices by 2026, while rents in Raleigh are expected to drop by 3.7%. The key factor behind this contrast lies in the differences in housing supply and demand between the two areas. Durham-Chapel Hill’s tighter housing market and growing demand are pushing rents upward, unlike Raleigh-Cary, where new housing developments are increasing competition and likely driving rents down.

Durham’s growing reputation as a center for businesses, education, and cultural attractions is attracting more renters, further fueling demand. On the other hand, Raleigh’s market is set to feel the effects of its expanding housing inventory, which could ease rental prices.