Property management fees in Raleigh-Durham typically range from 8% to 12% of monthly rent, with additional costs for tenant placement, maintenance, and other services. Here’s a quick overview:

- Monthly Management Fees: 8%-12% of rent; flat fees range from $100-$150/month.

- Tenant Placement Fees: 50%-100% of one month’s rent.

- Maintenance Markups: 10%-25% of repair costs.

- Lease Renewal Fees: $200-$500 per renewal.

- Inspection Fees: $50-$150 per visit.

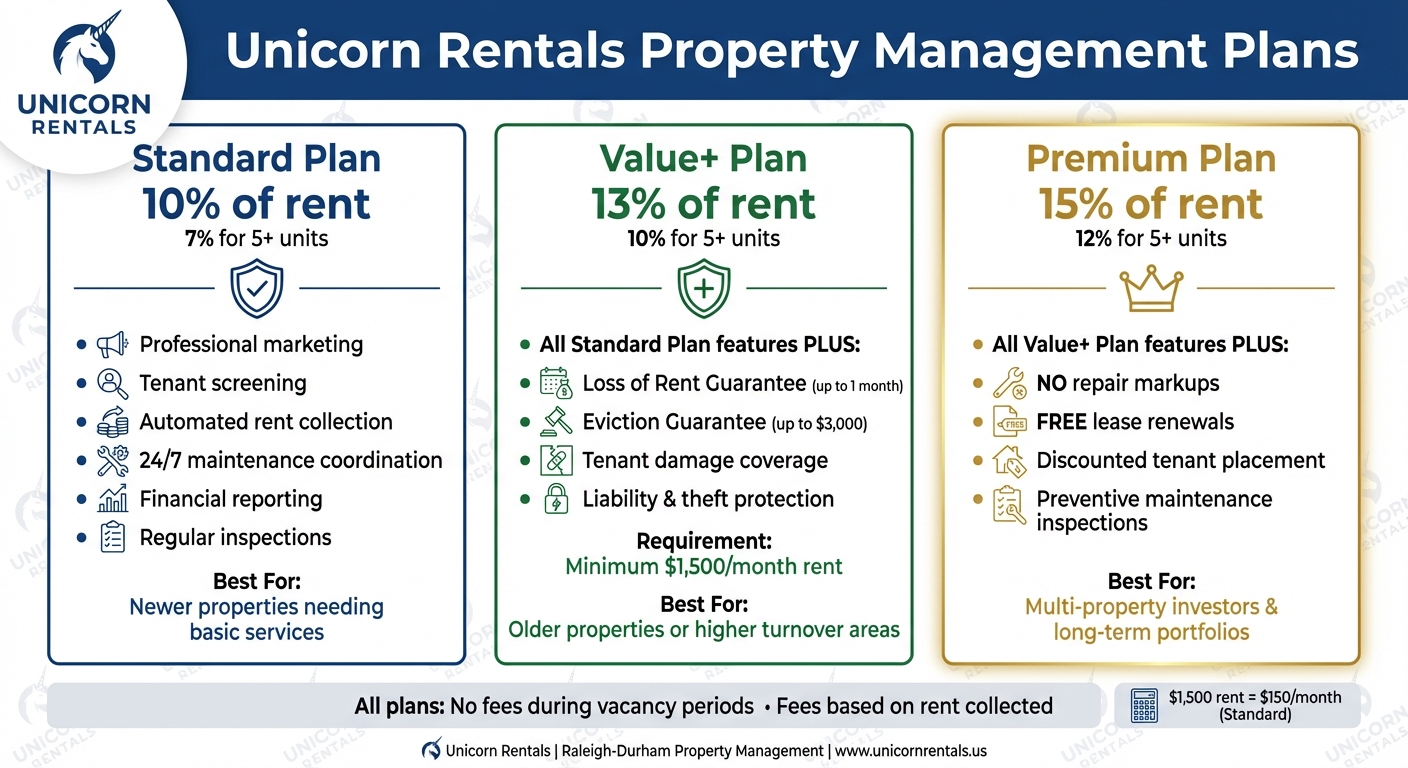

Key Plans by Unicorn Rentals:

- Standard Plan: 10% of rent (7% for 5+ units); includes basic services.

- Value+ Plan: 13% (10% for 5+ units); adds rent loss and eviction guarantees.

- Premium Plan: 15% (12% for 5+ units); no repair markups, free renewals, and preventive inspections.

For multi-unit owners, discounts can reduce costs significantly. Always review fee schedules to avoid hidden charges like admin or vacancy monitoring fees.

Property Management Fees Explained: Where Does Your Money Go?

Unicorn Rentals’ 3 Pricing Plans Explained

Unicorn Rentals Property Management Pricing Plans Comparison 2026

Unicorn Rentals offers three pricing options – Standard, Value+, and Premium – designed to fit the needs of property owners in the Raleigh-Durham area. These percentage-based plans are straightforward and scale with your property’s performance, starting at 10% of monthly rent (or 7% for portfolios of five or more units) for the Standard Plan. The Value+ Plan is priced at 13% (or 10% for five or more units), while the Premium Plan is 15% (or 12% for five or more units).

The percentage-based system ensures that costs align with your rental income. For example, if your property is vacant, you won’t be charged management fees during that period. Property owners can also tailor their services, choosing between full-service management or a "Lease Only" option, which handles tenant marketing and screening while leaving daily operations in your hands.

Tier 1 – Standard Plan

The Standard Plan provides the essential tools needed for property management at 10% of collected rent (or 7% for portfolios with five or more units). It includes:

- Professional marketing to attract tenants

- Comprehensive tenant screening (background and credit checks)

- Automated rent collection

- 24/7 maintenance coordination

- Detailed financial reporting

- Regular property inspections

This plan is a great match for owners of newer properties who need basic management services without extra frills.

Tier 2 – Value+ Plan

The Value+ Plan takes the Standard Plan a step further by adding an Owner Protection Package at 13% (or 10% for portfolios of five or more units). The package includes:

- Loss of Rent Guarantee: Covers up to one month of rent if a tenant fails to pay

- Eviction Guarantee: Provides up to $3,000 in legal assistance

- Coverage for tenant-caused damage, liability, and theft

This plan requires a minimum rent of $1,500 per month and is ideal for owners who want added financial security, particularly for older properties or those in areas with higher tenant turnover.

Tier 3 – Premium Plan

The Premium Plan offers all the benefits of the Value+ Plan, plus additional perks for 15% (or 12% for five or more units). These include:

- No repair markups

- Free lease renewals

- Discounted tenant placement fees

- Preventive maintenance inspections to address issues early

This plan is best suited for experienced investors or those managing multiple properties. Over time, the savings on repairs, renewals, and other expenses can make up for the higher percentage fee, especially for long-term investments.

Each plan is designed to give property owners the flexibility and support they need, whether they’re just starting out or managing a larger portfolio.

Leasing and Tenant Placement Fees

In the Raleigh-Durham area, leasing fees typically range from 50% to 100% of one month’s rent. On average, Durham sees fees around 70%, while Raleigh often hits the higher end at 100%, depending on the level of service provided.

These fees cover a wide range of services, including professional marketing (like high-quality photography), property showings, tenant screening (credit, criminal, and rental history checks), lease preparation, and coordinating move-ins. Comprehensive tenant screening is especially important – placing the wrong tenant could cost you four to six times the monthly rent.

At Unicorn Rentals, tenant placement fees are tailored to the pricing plan you choose. With the Standard Plan, full tenant placement services are already included in the 10% monthly management fee (or 7% for portfolios with five or more units). The Premium Plan offers discounted tenant placement fees alongside a 15% management rate (or 12% for portfolios), which can result in meaningful savings if tenant turnover occurs.

For property owners who prefer to handle day-to-day operations themselves, Unicorn Rentals offers a "Lease Only" option. This standalone service focuses on marketing and tenant screening and typically costs 100% of one month’s rent in the Raleigh area.

It’s also worth considering tenant replacement guarantees when assessing placement fees. Some property managers provide a free tenant replacement if a lease is broken within the first six months, saving you from repeated turnover costs.

Monthly Management Fees

In the Triangle area, monthly management fees typically range from 8% to 12% of the rent collected. Raleigh averages between 8% and 10%, while Durham can go as high as 12%. The percentage-based model means you’re only charged when your tenant pays rent – if the unit is vacant or rent isn’t collected, no fee is applied. For instance, if your property rents for $1,500 per month with a 10% management fee, you’d pay $150. Many companies also have minimum fees, usually between $85 and $200. For example, an 8% fee on a $1,000 rent would calculate to $80, but the minimum fee would bump it up.

These fees generally cover core services like rent collection, coordinating maintenance, 24/7 emergency support, tenant communication, lease enforcement, and monthly financial reporting. Many property managers in the Triangle also include perks like online owner portals and automated payment systems within their standard rates. This setup aligns with the detailed fee breakdown provided later in this guide.

It’s crucial to check whether your contract charges fees based on "rent collected" or "rent due" – you want the former. Otherwise, you could end up paying fees even when a tenant doesn’t pay their rent. Additionally, confirm whether fees apply during vacancies. One silver lining: management fees are tax-deductible as an operating expense, which can help ease the financial impact.

sbb-itb-aa27f6d

Maintenance and Repair Costs

For rental property owners in the Triangle area, maintenance expenses are one of the most consistent and necessary costs to plan for. A good rule of thumb is to set aside 1–2 times the monthly rent annually to cover repairs. For example, if your property rents for $1,500 a month, you should budget between $1,500 and $3,000 each year for maintenance. Skipping on these expenses can lead to higher tenant turnover and longer vacancy periods, which can be far more costly in the long run. These maintenance costs are a critical part of your overall operating budget.

In the Raleigh-Durham area, many property management companies charge a coordination fee for repairs. This fee is typically 10% to 25% of the vendor’s invoice (10% to 20% in Durham). For instance, if a plumber charges $500 to repair a water heater, the total cost with the coordination fee could range from $550 to $625.

"We troubleshoot maintenance issues with your tenant on the phone (before we call a vendor), often avoiding the need for a service call and saving you money." – Block & Associates Realty

If you’re looking to cut down on these added costs, Unicorn Rentals’ Premium Plan (Tier 3) might be worth considering. This plan eliminates repair markups entirely, charging 15% of the monthly rent (or 12% for properties with 5 or more units). Along with no-markup maintenance, the plan also includes free lease renewals, discounted tenant placement, and preventive inspections. For owners who frequently deal with repairs, this structure can offer notable savings compared to plans that combine a flat management fee with additional repair markups.

Proactive property management is another way to keep costs under control. Some firms handle up to 50% of service requests internally, which can significantly reduce vendor-related fees. Regular property inspections, which typically cost $50 to $150 per visit, can catch minor issues before they turn into major repairs. Additionally, having 24/7 emergency coordination included in your monthly management fee ensures that urgent problems are addressed quickly – helping to maintain your property’s value and keep tenants satisfied.

Additional Services and Fees

When managing Triangle properties, there are several additional fees to consider. These include lease renewal fees, which can range from $150 to $500 per renewal, account setup fees between $200 and $500, and inspection fees that fall between $50 and $200 per visit.

Eviction-related costs can also affect your budget. In the Raleigh-Durham area, most property managers charge $200 to $500 for handling the administrative side of evictions. This fee typically only covers management time – court costs and attorney fees are extra. To mitigate these expenses, some companies offer eviction protection plans for $10 to $30 per month, which may cover legal fees up to $2,000.

Other potential charges include annual administrative or technology fees, which are often around $300, and vacancy monitoring fees, ranging from $50 to $150 per month. Robert Dell’Osso, CEO of MasterKey Property Management, emphasizes the importance of reviewing contracts carefully:

A landlord in Raleigh was paying 9% but didn’t realize a $300 annual admin fee was in his contract – always read the fine print.

Unicorn Rentals takes a transparent approach to these fees, offering structured plans to help owners save money. For example, their Standard Plan (Tier 1) includes basic services but charges separately for lease renewals and inspections. On the other hand, the Premium Plan (Tier 3) – priced at 15% of monthly rent (or 12% for owners with 5+ units) – covers many of these costs upfront. This includes free lease renewals and no repair markups, which can make a big difference for long-term profitability.

To avoid surprises, always request a detailed fee schedule in writing. This should include costs for setup, renewals, inspections, eviction support, and any annual administrative charges. Confirm that fees are based on rent collected, as clear and accurate disclosure is key to maintaining your bottom line.

Discounts for Multi-Unit Properties

Owning and managing several properties in the Triangle area can lead to substantial savings. Unicorn Rentals has designed its pricing to reward landlords who expand their portfolios. For instance, under the Standard plan, the management fee drops from 10% to 7% for owners with five or more units. Let’s break that down: if you own five properties, each renting for $1,500 a month, you’d save $45 per unit monthly. That’s a total of $225 in savings every month, or $2,700 annually. This pricing structure reflects a broader trend in the industry, where managing multiple units often comes with cost advantages.

Across the Raleigh-Durham market, multi-unit pricing typically results in lower costs. On average, landlords see a 15.5% reduction per unit when managing portfolios of three to ten homes. For example, with a flat-fee model, a single property might cost $129 per month to manage. However, for a portfolio, that fee could drop to about $109 per unit – saving around $20 per property each month.

Unicorn Rentals takes these savings a step further with its Premium Plan. For landlords with five or more units, the management fee decreases from 15% to 12%. Additionally, this plan includes perks like free lease renewals and no repair markups, which can further reduce overall costs.

For institutional investors managing ten or more units, Unicorn Rentals offers customized plans that go beyond standard tiered rates. These plans often include volume discounts on maintenance, where savings from vendor relationships are passed directly to property owners. As Mynd Property Management explains:

In the event we receive a volume discount from a vendor or supplier, we pass on those savings [to the investor].

To calculate your potential savings, subtract the discounted multi-unit rate from your current single-unit rate, then multiply by the number of properties in your portfolio. It’s also a good idea to request a written quote tailored to your portfolio size and service needs. Consolidating your properties under one management company not only simplifies reporting but also reduces administrative work. These multi-unit discounts highlight the financial benefits of streamlining property management with Unicorn Rentals.

Key Takeaways for Property Owners

Understanding the full fee structure – covering everything from leasing and maintenance to hidden charges – is crucial for getting the most out of your investment. The total cost of ownership includes leasing fees, maintenance markups, renewal charges, and potential hidden costs like annual admin fees or technology charges. To avoid unexpected expenses, always ask for a complete fee schedule in writing before signing any agreements.

When deciding between percentage-based and flat-fee management plans, your property’s rent level plays a big role. For high-rent properties (over $3,000 per month), flat fees often save money. On the other hand, percentage-based models (typically 8–12%) tend to work better for average-rent units, as they encourage property managers to maximize your income. Be sure to confirm that fees are based on "rent collected" rather than "rent due", so you’re not paying when tenants miss payments. This detail is especially important if you’re considering portfolio discounts, which we’ll touch on next.

Minimizing tenant-related costs is another key to protecting your investment. Placing the wrong tenant can cost 4 to 6 times the monthly rent, and the average eviction loss for a $1,000/month rental is $4,950. A skilled property manager can save you money by avoiding these costly mistakes. As Real Property Management Raleigh explains:

A REAL property manager offsets their own fees by maximizing rents, minimizing vacancies, and avoiding costly mistakes… don’t step over dollars to pick up a dime.

If you own multiple properties, portfolio discounts can significantly lower your costs – by an average of 15.5% per unit. For landlords managing five or more units, negotiating custom pricing and asking about volume discounts on maintenance services can result in substantial savings – potentially thousands of dollars each year.

Based on the fee breakdowns above, tailor your management approach to fit your property’s specific needs. For example, out-of-state owners or those with 10 or more units often benefit most from full-service management. Meanwhile, local landlords with fewer than five properties might explore hybrid options, like using property management software for routine tasks. The best choice ultimately depends on your time, expertise, and the size of your portfolio.

FAQs

What affects the monthly property management fees in Raleigh-Durham?

The monthly property management fee in Raleigh-Durham depends on a mix of factors. One key element is the service level you opt for – standard plans usually hover around 8%, while premium plans can climb as high as 12.9%. Another consideration is the size and type of your property or portfolio, as larger or multifamily properties often come with higher rates. Additionally, local market trends play a role in determining fees.

Other factors to keep in mind include the vacancy status of your property – some companies waive fees if the unit is unoccupied – and whether the plan covers extra services like maintenance or tenant support. By weighing these elements, you can find a plan that balances cost and services to suit your needs.

Does Unicorn Rentals offer discounts for managing multiple properties?

At the moment, there’s no detailed information about multi-unit discounts in Unicorn Rentals’ pricing plans. If you have any extra details or documents about their pricing structure, feel free to share them – we’d be glad to help clear things up!

What are the advantages of the Premium Plan compared to the Standard Plan?

The Premium Plan offers landlords added security and convenience compared to the Standard Plan. A standout feature is its $3,000 pet-damage guarantee, which is a step up from the Standard Plan’s $2,000 guarantee – perfect for owners of pet-friendly properties looking for extra peace of mind.

Both plans include essential services such as 24/7 maintenance coordination, tenant screening, financial reporting, eviction protection, and rent collection. However, the Premium Plan takes it further with a flat fee of 12.9% of monthly rent, eliminating the variability of the Standard Plan’s 6.9%–9.9% rate. This flat rate not only simplifies budgeting but also comes with priority access to the management team, ensuring quicker resolutions to any issues and a smoother experience for tenants.

For landlords seeking a hands-off approach, maximum protection, and straightforward pricing, the Premium Plan is a great match.

Related Blog Posts

- Raleigh & Durham Rental Market 2026: Trends, Rent Forecasts, and What It Means for Landlords

- How Much Should You Charge for Rent in Raleigh, Durham & Chapel Hill in 2026 (By Bedroom & Neighborhood)

- Renting vs. Buying in the Triangle: A Complete Cost and Lifestyle Comparison for First-Timers

- How to Reduce Vacancy Time in Raleigh Rental Properties: 9 Proven Strategies