In 2026, setting the right rent in Raleigh, Durham, and Chapel Hill is critical as the market stabilizes with more rental options and steady demand. Here’s what you need to know:

- Raleigh: Average rent is $1,695. One-bedroom units range from $1,198–$1,436, while four-bedroom houses average $2,534.

- Durham: Average rent is $1,899. One-bedroom units cost $1,200–$1,339, and four-bedroom homes average $2,495.

- Chapel Hill: Median rent is $1,900, with university areas commanding higher prices.

Key trends:

- Rental prices are stable, with some areas seeing slight increases (e.g., Chapel Hill up 4% year-over-year).

- Incentives such as free rent or gift cards are common to attract tenants.

- Neighborhoods like Downtown Raleigh ($2,095 for a one-bedroom) and Hope Valley in Durham ($2,075) are pricier, while areas like South Park in Raleigh ($995 for a one-bedroom) and Duke Forest in Durham ($1,319) are more affordable.

To set competitive rates:

- Use local data, such as ZIP code-specific averages.

- Consider property type and features, as houses often rent for more than apartments.

- Offer perks to reduce vacancy time in high-inventory areas.

Pricing your rental property accurately ensures steady income and attracts reliable tenants in this evolving market.

Rent prices dropping across Triangle, new report says

sbb-itb-aa27f6d

2026 Rental Market Overview for Raleigh, Durham, and Chapel Hill

The rental market in the Triangle region – covering Raleigh, Durham, and Chapel Hill – presents a mix of trends as of January 2026. In urban centers, median rents in Raleigh ($1,695) and Durham ($1,719–$1,899) are 9% to 11% below the national median of $1,995, while Chapel Hill reaches $1,900. In contrast, the broader Raleigh-Durham metro area shows a median of $2,502, which is 32% higher than the national average. This highlights how location within the metro area can significantly influence rental prices.

Looking at year-over-year trends, rental prices have remained stable. Both Raleigh and Durham experienced no growth in 2026, a notable shift after years of rapid increases. Chapel Hill saw a modest 4% rise, while the overall metro area grew by 6%. On a national scale, rents are predicted to drop by 1.0% in 2026, showing that the Triangle is maintaining its value better than many other markets. These steady trends are setting the stage for adjustments in supply and demand.

Shifting Supply and Landlord Strategies

An increase in available rentals is reshaping the market. With over 2,000 options in Raleigh and more than 700 in Durham, renters now have more choices than in recent years. This surge in inventory is reflected in the average time on the market for multifamily units in Raleigh, which is just 28 days. Jake Krimmel, Senior Economist at Realtor.com, commented on this shift:

Raleigh is approaching ‘buyers’ market territory’ with inventory building well above pre-pandemic levels and sales remaining slow

.

A boom in multifamily construction across the South is a driving force behind this supply increase. Realtor.com predicts:

renters are likely to see continued relief from declining rents in 2026, as a robust multifamily construction pipeline adds to rental supply and helps drive rents down

. This construction wave is not only expanding supply but also forcing landlords to rethink pricing strategies. Vacancy rates are trending toward a long-term average of 7.2%, and incentives like free rent or gift cards are becoming more common to attract tenants.

What’s Influencing Rental Prices in 2026?

Several economic factors are shaping rental prices. Declining mortgage rates play a major role, with the average 30-year mortgage forecasted at 6.3% for 2026. As rates ease, pent-up demand from potential homebuyers is expected to benefit areas like Durham and Chapel Hill more than Raleigh, where inventory remains higher. Employment opportunities and migration patterns also contribute to demand, with the Triangle identified by Realtor.com as a top destination for recent college graduates seeking affordability and career prospects.

Property-specific factors also play a significant role. In Raleigh, the average rent per square foot is $1.31, while in Durham, it’s $1.50. Houses generally command higher rents than apartments – Durham houses average $1,997 compared to $1,525 for apartments, and Raleigh houses rent for $1,900 versus $1,395 for apartments. Location is a key factor, with 47% of Raleigh apartments falling in the $1,501–$2,250 range. Understanding these local dynamics is essential for landlords aiming to set competitive and fair rental rates that reflect their property’s value.

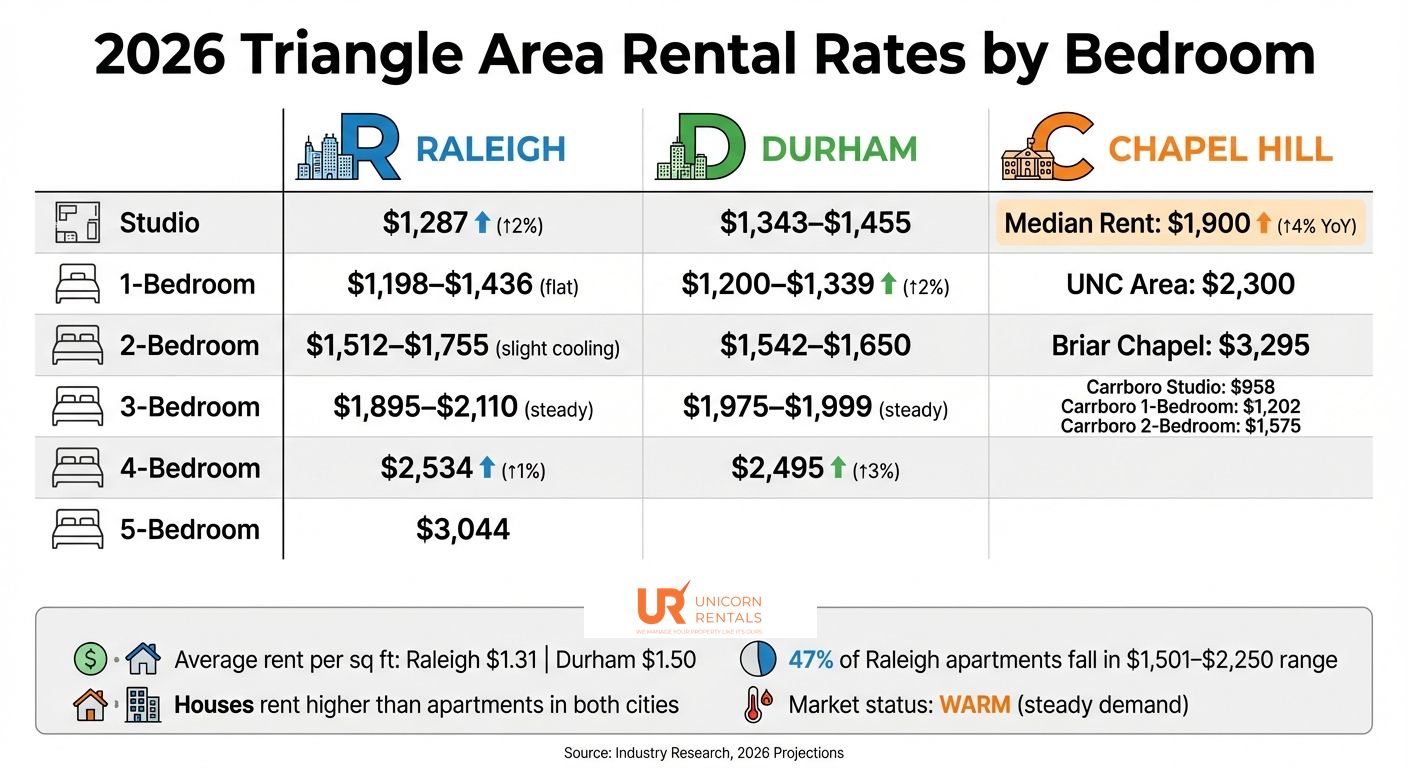

Average Rental Rates by Bedroom Count

2026 Rental Rates by City and Bedroom Count in Triangle NC

The number of bedrooms in a rental property is one of the clearest factors influencing pricing in the Triangle. Data reveals distinct pricing tiers that landlords can use as a reference when determining rent for their properties.

Studio and 1-Bedroom Apartments

In Raleigh, studio apartments average $1,287 per month, reflecting a 2% increase, while one-bedroom units fall between $1,198 and $1,436, showing no significant change year-over-year. In Durham, studio rents range from $1,343 to $1,455, while one-bedroom apartments cost between $1,200 and $1,339. Location within the city plays a major role – Raleigh’s North ZIP code (27615) offers one-bedroom units for about $1,230, while downtown areas like 27601 and 27605 see prices closer to $1,750. The type of property also impacts pricing. For example, one-bedroom houses in Raleigh rent for around $1,020, which is notably lower than the $1,436 average for apartments. In Durham, demand for smaller units remains slightly above the national average, with the rental market described as "warm".

2- and 3-Bedroom Units

Mid-sized units are popular among roommates and small families. In Raleigh, two-bedroom apartments typically range from $1,512 to $1,755, while three-bedroom units cost between $1,895 and $2,110, depending on the property. In Durham, two-bedroom rentals fall between $1,542 and $1,650, while three-bedroom units average $1,975 to $1,999. Houses in this size category often showcase different pricing dynamics. For instance, two-bedroom houses in Raleigh average $1,719 – slightly below apartment rates – while three-bedroom houses cost around $2,093. ZIP code variations highlight these differences further. A two-bedroom apartment in downtown Raleigh (27601) averages $2,398, while a similar unit in Southeast Raleigh (27610) is priced closer to $1,765. In Chapel Hill, the median rent of $1,900 reflects the influence of its university-driven market, with properties near campus often commanding higher prices. These mid-sized rentals remain in strong demand, attracting both students and young professionals.

4-Bedroom Homes and Larger Properties

Larger homes, typically favored by families, see their pricing shaped by factors like school districts and neighborhood amenities. In Raleigh, four-bedroom houses average $2,534, while five-bedroom homes can reach $3,044. In Durham, four-bedroom properties average $2,495, marking a 3% increase from the previous year. Location creates significant price differences for these larger properties. For example, four-bedroom houses in Raleigh’s Five Points/Hayes Barton area (27608) average $4,780, while similar homes in Northwest Raleigh (27612) cost around $3,594, and Southeast Raleigh (27610) averages $2,292. A notable outlier is four-bedroom apartments in Raleigh, which average only $1,472. This reflects a per-room leasing model often seen in student housing near NC State, where individual bedrooms are rented separately. For single-family homes, landlords can justify higher rates by emphasizing benefits like private yards, spacious layouts, and family-friendly neighborhoods.

| Unit Size | Raleigh Average | Durham Average | Key Trend |

|---|---|---|---|

| Studio | $1,287 | $1,343–$1,455 | Stable, +2% in Raleigh |

| 1-Bedroom | $1,198–$1,436 | $1,200–$1,339 | Flat in Raleigh, +2% in Durham |

| 2-Bedroom | $1,512–$1,755 | $1,542–$1,650 | Slight cooling in Raleigh |

| 3-Bedroom | $1,895–$2,110 | $1,975–$1,999 | Steady demand |

| 4-Bedroom | $2,534 (house) | $2,495 | +1% in Raleigh, +3% in Durham |

These figures provide a solid foundation for landlords to price their properties competitively while staying aligned with local market trends and forecasts.

Rental Pricing by Neighborhood

When it comes to rental prices, the neighborhood you choose can significantly impact what you’ll pay, just like the number of bedrooms in a property.

Highest and Lowest Priced Neighborhoods in 2026

Neighborhoods across the Triangle display a wide range of rental prices. In Raleigh, the Warehouse District leads the pack, with one-bedroom apartments averaging $2,113 and two-bedroom units reaching $3,384. Close behind is Mordecai, where one-bedroom rentals average $1,903 and two-bedrooms hit $3,116. On the more affordable side, South Park offers one-bedroom units for just $995, while King Charles averages $1,060 for one-bedroom apartments and $1,200 for two-bedrooms.

Durham also shows notable price differences. Hope Valley has the highest median rent at $2,075, closely followed by Parkwood at $2,025. More budget-friendly options include East Durham and Watts Hospital Hillandale, both averaging $1,495, while Duke Forest offers the lowest rates at $1,319. Downtown Durham sits somewhere in the middle, with one-bedroom units averaging $1,831.

In Chapel Hill, prices remain high, especially near the university. The UNC Chapel Hill area sees median rents of $2,300 for one-bedroom apartments, while upscale neighborhoods like Briar Chapel reach $3,295. Neighboring Carrboro offers more affordable options, such as studios for $958, one-bedroom units for $1,202, and two-bedroom apartments for $1,575 [2,13].

These price disparities often reflect factors like proximity to downtown areas, major employers (such as Research Triangle Park), top-rated schools, and local amenities. Properties near universities consistently fetch higher rents due to steady demand from students and faculty. These trends highlight where tenant interest is strongest and why.

Where Rental Demand Is Strongest

Beyond pricing, certain neighborhoods consistently attract renters due to high demand. University areas are a prime example. Around NC State (ZIP codes 27606 and 27607), students and young professionals drive demand, with four-bedroom homes in 27607 averaging $3,433. Similarly, neighborhoods near Duke University and UNC Chapel Hill see low vacancy rates due to steady interest from both students and faculty [1,13].

Downtown areas also remain popular, especially for professionals. Downtown Raleigh (ZIP 27601) saw a 7.44% increase in rental prices month-over-month in late 2025, with two-bedroom apartments averaging $2,398 [6,9]. In Durham, Downtown Durham benefits from its proximity to Duke and the city’s central business hubs, making it a sought-after location. Mixed-use developments like Brier Creek (averaging $1,784) and North Hills (averaging $1,608) in Raleigh appeal to renters looking for walkable access to offices, shops, and dining.

Currently, both Raleigh and Durham are considered "WARM" rental markets, indicating steady tenant interest without overwhelming competition [1,7].

How to Set Fair and Competitive Rental Rates

Finding the right rental price is all about balancing tenant interest with the value of your property. A great place to start is by using online valuation tools like Zillow’s "Price my rental" or Rentest’s "RentEstimate." These platforms provide localized data tailored to your neighborhood by analyzing comparable properties and reflecting current market trends. They build on the broader market insights you may already have.

Property type plays a big role. For example, in the Raleigh-Durham area, houses often rent for much more than apartments. When comparing properties, make sure you’re matching like with like – a three-bedroom house in North Raleigh should be compared to other similar houses, not apartment units.

In Raleigh and Durham’s "Warm" markets, overpricing can lead to extended vacancies. Dig into ZIP code-level data to spot variations. For instance, rents for one-bedroom units average $1,746 in Raleigh’s 27601 area, while the 27610 area averages $1,286. These differences highlight the importance of hyperlocal research.

If you’re open to Section 8 tenants, consider checking HUD Fair Market Rents (FMR). In 2024, the 40th-percentile FMR for a two-bedroom unit in Durham-Chapel Hill was $1,631. Additionally, rental clusters can guide your pricing strategy. In Raleigh, nearly half of apartments fall within the $1,501 to $2,100 range, making it a competitive sweet spot.

In markets with high inventory, strategic concessions can help attract tenants without permanently lowering your price. For example, 52% of Raleigh rental listings in Q1 2025 offered perks like a free month of rent or gift cards. These incentives can draw tenants while keeping your listed price intact for future adjustments.

Another useful benchmark is the local average of $1.50 per square foot. Adjust this rate based on your unit’s size – smaller or larger properties may need price tweaks to stay competitive.

Pricing for Property Features and Amenities

Once you’ve established a baseline rate, consider how your property’s features can influence pricing. Updated, move-in ready homes tend to rent faster and justify higher rates. At a minimum, ensure essentials like electrical systems, plumbing, and heating are functional, as required under North Carolina’s implied warranty of habitability (G.S. 42-42).

Location-based amenities can also boost your rental price. Properties in walkable neighborhoods like Downtown Raleigh or Five Points often attract more interest and can command higher rents. Proximity to major employment hubs matters too – homes within 30 miles of tech campuses like Apple’s $1 billion campus or Meta’s data center appeal to professionals with higher incomes.

Features like green infrastructure and energy-efficient upgrades can add value as well. Renters are often willing to pay 5%–8% more for properties with energy-saving appliances, LED lighting, or sustainable stormwater systems. Additionally, properties near planned transit stations could see rent increases of 15%–20% by 2026.

Following North Carolina Rental Regulations

Competitive pricing is only part of the equation – staying compliant with North Carolina rental laws is equally important. The Tenant Security Deposit Act (Article 6) outlines how to handle deposits, including collection, storage, and return. Recent updates, such as those in Session Laws 2024-47 and 2025-54, have adjusted authorized fees under G.S. 42-46. Review these changes to ensure your late fees and administrative charges are within legal limits.

It’s also critical to avoid retaliatory rent increases. North Carolina law (G.S. 42-37.1) prohibits raising rent or evicting tenants for asserting their legal rights, like requesting repairs. Any rent adjustments should be based on market conditions, not retaliation.

Before setting premium rates, make sure your property meets habitability standards under G.S. 42-42. Failure to maintain essentials like heating, plumbing, or electrical systems could lead tenants to withhold rent or terminate their lease. Staying compliant protects your income and helps you avoid legal headaches.

Lastly, fair housing laws require that rental decisions are free from discrimination. This includes ensuring rental rates and availability are not influenced by a tenant’s protected status, such as being a victim of domestic violence (G.S. 42-42.2). Consistently apply pricing criteria based on market data and property features, not personal factors.

Keep in mind that North Carolina law (G.S. 42-14.1) overrides local government rental regulations. This ensures a uniform set of rules across cities like Raleigh, Durham, and Chapel Hill, making it easier to stay compliant no matter where your property is located.

Conclusion

Setting accurate, localized rental prices is more important than ever in today’s steady yet competitive market. In Raleigh, Durham, and Chapel Hill, understanding the nuances of your specific market is the first step. As of January 2026, the Triangle area is seeing stabilization, with 70% of property managers anticipating rent prices to hold steady through mid-year. Pricing too high could mean longer vacancies, which already average 24 to 28 days in the area.

The key to success lies in hyperlocal data. City-wide averages can only tell part of the story; neighborhood-specific insights are what really matter. For example, Downtown Raleigh rentals average $2,095, while North Raleigh properties are closer to $1,485. In Durham, Central Park rentals hover around $2,248, compared to American Village at approximately $1,193. Tools that focus on ZIP-code-level data can help you capture these differences and set competitive prices that align with local demand.

Strategic concessions can also play a role in reducing vacancy rates. Offering the right incentives can make your property more appealing without significantly impacting your bottom line. Meanwhile, staying compliant with North Carolina’s rental regulations not only protects your revenue but also strengthens your position in the market.

Unicorn Rentals provides a full suite of property management services – from marketing and tenant screening to rent collection and 24/7 maintenance – starting at 10% of monthly rent (or 7% for properties with 5+ units). With these tools and insights, you can confidently navigate this evolving market and maximize your rental income.

FAQs

How do rental prices vary by neighborhood in Raleigh, Durham, and Chapel Hill?

Rental prices in Raleigh, Durham, and Chapel Hill vary widely based on the neighborhood. Key factors like closeness to major employers, universities, public transportation, and local amenities heavily influence demand and, in turn, rental rates.

In Durham, central neighborhoods like Downtown and Burch Avenue typically have higher rents, with one-bedroom apartments averaging about $1,737. On the other hand, areas farther from the city center, such as Edgemont or American Village, often offer more affordable options, with rents generally falling between $1,600 and $1,660. The higher prices in central areas reflect the value renters place on being near downtown attractions, Duke University, and popular cultural spots.

Raleigh follows a similar pattern. The average rent for a one-bedroom apartment across the city is $1,353, but neighborhoods near Research Triangle Park, North Hills, or downtown tend to command higher prices compared to those further out. In Chapel Hill, demand from students and faculty at UNC-Chapel Hill drives up rents in neighborhoods close to the campus.

For landlords, understanding the unique appeal of each neighborhood – whether it’s proximity to job centers, schools, or entertainment – can help in setting competitive rental rates to maximize income potential.

How can landlords in Raleigh, Durham, and Chapel Hill set the right rental prices in 2026?

To set competitive rental prices in 2026, landlords should base their decisions on local market data and current trends. Start by examining the average rents for similar properties in your area, broken down by the number of bedrooms. This gives you a clear picture of what tenants are paying for comparable units nearby. Additionally, keep an eye on broader rental trends, such as month-over-month or year-over-year changes, to ensure your pricing matches market shifts.

Pay attention to supply and demand dynamics in your neighborhood. For instance, if there’s an increase in available rental units but tenant demand remains strong, you might still justify modest price increases without losing potential renters. It’s also crucial to align your pricing with Fair Market Rent (FMR) guidelines for your region, especially if you participate in subsidy programs.

Don’t forget to factor in property-specific details like amenities, square footage, and any recent upgrades. Adjust your pricing seasonally if necessary, and consider experimenting with small changes to find the sweet spot where tenant interest meets profitability.

How does an increase in rental properties impact vacancy rates and rent pricing in the Triangle area?

When there are more rental units available than tenants to fill them, vacancy rates naturally increase. This often results in downward pressure on rental prices. Take Raleigh, for instance – recent data shows rental prices there dropped by about 1.9% year-over-year. Chapel Hill experienced even steeper declines, with studio rents falling 14% and one-bedroom units dropping 13%.

Higher vacancy rates push landlords to rethink their pricing strategies. Instead of solely aiming to maximize rent, they may introduce incentives to attract tenants. These could include reduced security deposits, a free first month of rent, or upgraded amenities. Keeping an eye on local vacancy trends and making gradual adjustments to rental rates can help ensure your property stays occupied while staying aligned with market conditions.